Investment Fund Project

Domestic Investment Funds

In today's market, financial investment funds appear more and more popular. So have you ever wondered what are the characteristics and benefits of this investment fund for investors? The concept of investment funds and how to invest effectively in funds will be answered in the following article

What is a financial investment fund?

A financial investment fund or investment fund is established with the purpose of mobilizing capital by gathering many investors to contribute capital together to participate in the financial market.

Investment funds are established by Fund Management Enterprises and operate in association with such management companies. The investment fund's operational goal is to bring optimal profits to investors participating in capital contribution, analysis, evaluation and research of suitable portfolios. The fund can invest in stocks, bonds, foreign exchange and currencies, valuable papers,... Depending on the trend of the market, the management company will make the most effective and optimal decisions.

This fund will issue fund certificates outside the market and investors will review, analyze and decide whether to participate or not. The financial investment fund will not directly receive money from participants but must pass fund certificates. This is a type of document proving the obligations, responsibilities and rights that financial investment funds as well as investors must perform.

The Financial Investment Fund was established with the aim of mobilizing capital from many investors to contribute capital

Types of prestigious investment funds in Vietnam

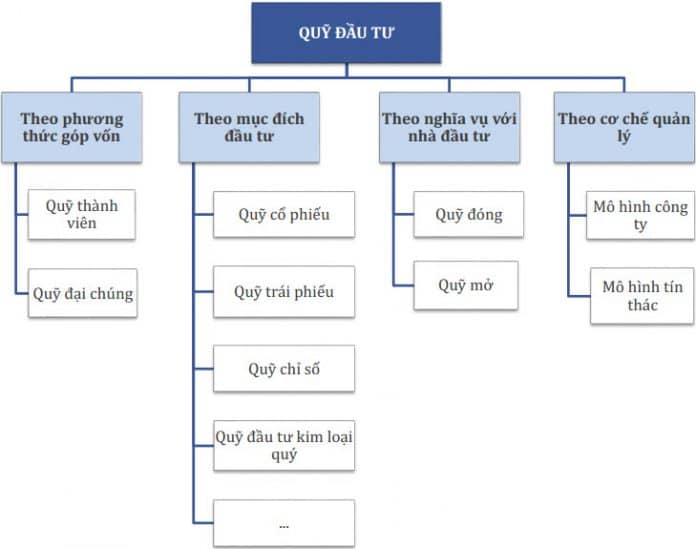

Currently, investment funds in Vietnam are classified in the following forms:

In the form of capital mobilization:

Public fund: This type of fund is not bound by the law on the number of participants.

Member Funds: This fund is established with the capital of certain investors.

According to the obligations to investors:

Closed-end funds: Investors do not need to buy fund certificates in the public and are not revoked, but only allowed to transfer.

Open-ended funds: The fund must fulfill investor requirements, such as the acquisition of fund certificates.

According to the fund management mechanism:

Company models: In the form of a joint stock company, with legal status, the shareholders of the enterprise will enjoy many benefits.

Contract investment funds: With this model, the management company will open the fund and call for capital mobilization from investors and make investments based on the goals set out in the fund's charter.

Trust Models: Investors will contribute capital together to collect profits, do not have legal status and are approved by the Ministry of Finance.

According to the investment object:

Equity Investment Fund;

Bond Investment Fund;

Index Investment Fund;

Precious Metals Investment Fund;

Money Market Investment Fund,...

How investment funds work

Investment funds work by recovering capital from investors and using it to buy stocks, futures, real estate, and other asset classes. Investment funds try to make a profit from owning these assets and share these profits with investors.

The investment fund is designed and operated according to the following 3-step process:

Step 1: Raise capital: The investment fund receives capital from investors through the sale of fund certificates.

Step 2: Investment: The expert team of fund management companies will use the capital to buy stocks, futures, real estate and other assets according to a predetermined investment strategy.

Step 3: Valuation, issuance and redemption of fund certificates: The fund management company will calculate the value of the fund certificate according to the formula: Fund certificate price = Total net asset value of the fund (NAV) / Total number of issued fund certificates (CCQ).

In the case of open-ended funds, the price of the fund certificate will be equal to NAV/CCQ plus the transaction fee. The management company will also buy back the certificate if there is an investor who wants to sell it.

In the case of a closed-end fund, the price of the fund certificate will depend on the demand in the market, similar to that of stocks.

Benefits of Investment Funds in Vietnam

When investing in investment funds in Vietnam, you will receive some practical benefits as follows:

Highly professional organizations

Investment Funds in Vietnam are established and operated by reputable, professional, and experienced Fund Management companies, such as VinaCapital. In addition, the Funds always have the resources to monitor and actively buy and sell investments to bring profits to participants.

Diversify investment portfolios, minimize risks

With the advantage of large capital sources, the fund can diversify its investment portfolios. From there, the dispersion of risks and optimization of profits will be better implemented.

High liquidity

In case of an emergency, you need to use the money you are investing or saving. It will be relatively easy to withdraw 1 part or all of it from the Fund because of the daily or weekly trading frequency.

Suitable for financial ability

Anyone can participate in investing in prestigious Fund organizations in Vietnam with low investment costs.

The interests of investors are always upheld and protected

When participating in the Vietnam Investment Fund, you will be provided with information about the Open Fund in a clear and transparent manner through the Fund's reports and data. Each Fund is supervised and inspected by a bank independent of the Fund Management Enterprise to ensure that the operation of the Vietnam Investment Fund is in accordance with the provisions of the Fund's Charter and the Law.

Some notes when investing in financial investment funds

Before deciding to invest in any type of Fund, you need to carefully research important factors such as the Fund's net asset value (NAV), the level of risk that participants can accept, and the actual costs that investors need to pay,...

Net Worth (NAV): Represents the growth of the Fund's profits. Investors can rely on that to make decisions about whether to invest or not.

Minimum investment value: This will depend on the regulation of each Fund. There are many Open-ended Funds that allow you to invest at a low cost. For example, an open-ended fund managed by VinaCapital only requires a minimum of VND 2 million, you can open an investment.

Costs to be paid by investors: Usually, you need to calculate expenses such as fund certificate purchase fees, supervision fees, fund management fees, administrative fees, valuation fees,...

Risk level: Despite being managed by businesses and professional teams, Funds are not immune to market volatility. Therefore, when investing in financial funds, you need to choose competent and reputable Fund Management Companies to entrust the money to them.

Procedures: Before investing, you need to open a fund certificate trading account at the margin trading company of your choice. After that, you need to make documents related to fund certificate trading orders and fund certificate trading forms.

Track Investments: In addition to tracking your net worth, you can stay up-to-date on the status of your investments to make the right decisions through the Fund's reports.

Prestigious investment funds in Vietnam

After understanding the concept of investment funds, the characteristics and benefits of the fund, let's follow the information table about the top prestigious investment funds in Vietnam compiled by us as follows:

How to participate in fund investment effectively?

Currently, fund certificates are a very popular form of investment. However, any form of investment has different potential risks. To be able to invest in funds effectively, investors need to know how to select types of investment funds that can meet some of the criteria below:

The fund has a long history of operation, has a reputation and a certain position in the market.

Diversified investment portfolio and high professionalism, reputable website and providing information in a transparent and clear way.

The fund is managed by a team of reputable and experienced experts.

Regularly update information for investors, ready to answer questions and provide information to participants when needed.

Choose a fund that is in good performance and has high returns based on reference to reputable funds or similar funds managed by other companies.

Consider choosing funds that are highly appreciated by professional investors.

Thus, with the above information, you can already know the advantages of investment funds such as flexibility, meeting diverse investment needs and professional asset management,... This is a top choice of investors who want a professional, reputable and stable profit place to deposit their money.

Currently, you can participate in open-ended investment forms or investment solutions that are researched and outlined by a team of veteran experts and potential and safe investment plans.

What is a Foreign Fund? What are the risks of investing in foreign funds?

An offshore fund is a type of fund that invests in companies that are based internationally or outside the investor's country of residence. What are the risks of investing in foreign funds?

Foreign funds are financial funds established by investors, which differ from other funds in that the main feature is that they are established abroad. So what are the regulations on foreign funds, how are the risks when investing in foreign funds regulated?

What is a Foreign Fund?

– Concept of foreign funds:

An offshore fund is a type of fund that invests in companies that are based internationally or outside the investor's country of residence. Foreign funds are also known as international funds. Foreign funds can be mutual funds, closed-end funds, or exchange-traded funds.

– Foreign funds, or international funds, are funds that invest in companies based in countries outside where the investor lives. Foreign funds are different from global funds, which include companies in the investor's home country and abroad. Foreign funds can be mutual funds, exchange-traded funds or closed-end funds. Foreign funds are riskier investments than domestic funds due to exposure to currencies, changing economies, and geopolitical issues. However, for savvy investors, these riskier funds can also offer higher returns, especially when included in the portfolio as an alternative to long-term core holdings.

2. Risks when investing in foreign funds:

Risks of investing in foreign funds:

Foreign funds provide individual investors with access to international markets. Investing internationally is risky, but it can also help investors diversify their portfolios. International funds can help investors broaden their investment horizons, leading to a higher potential return on capital.

For U.S. investors, international funds may include developed, emerging, or marginal market investments. Investing in these markets can offer higher profit potential and diversification, but they can also carry higher risks.

– Risks associated with foreign capital: Investing in international funds can bring higher returns, but it can be more risky than investing in domestic funds. As a riskier investment, offshore funds are often best used as an alternative to long-term core holdings.

Some factors that can increase risk include currencies and the changing economy. Currencies are often a concern when investing in any type of international investment because currency volatility can affect the actual returns of an investor's portfolio.

Changing economies are also a factor and require consistent due diligence as changing regulations and laws can affect the economic trends of international market countries.

– Foreign Funds vs. Global Funds: Foreign funds include securities from all countries except the investor's home country. These funds offer diversification outside of the investor's domestic investments. If an investor currently holds a portfolio that consists primarily of domestic investments, they can choose to diversify to hedge against country-specific risks and buy an international fund.

Global funds include securities in all parts of the world, including the country in which the investor resides. Global funds are chosen primarily by investors who want to diversify against country-specific risks without excluding their country. Such investors may already have a lower level of domestic investment concentration than desired or may not be willing to accept the high level of risk associated with foreign investment.

+ The Global Fund provides investors with a diversified global portfolio. Investing in international stocks can increase the potential returns of investors, accompanied by some additional risks. A global fund can help mitigate some of the risks and concerns that investors may face when considering international investments.

A global fund is a fund that invests in companies anywhere in the world including the investor's country. Global funds seek to identify the best investments from the global stock world. A global fund can focus on a single asset class or be allocated to multiple asset classes.

Globally, investment areas are often described as developed markets, emerging markets, and marginal markets. Each category includes countries with their own characteristics and risks. Developed markets represent companies with mature economies and efficient infrastructure, especially for transactions in the financial markets. Emerging markets often offer the greatest profit opportunities, as they are some of the largest and fastest-growing economies in the world. Marginal markets will carry the highest risk, as they are the least developed. A global fund can invest in any region or country in the world. It can choose a specific level of concentration, or it can invest extensively across asset classes and countries. Global funds can be offered as closed-end mutual funds, open-ended mutual funds, or exchange-traded funds (ETFs).

– Debt and Equity Foreign capital sources:

Debt funds and equity funds are the two most popular foreign funds. U.S. investors looking to place more cautious bets can invest in government or corporate debts from different countries outside the United States. Equity funds provide investors with a diversified portfolio of stocks that can be managed according to a variety of objectives. Asset allocation funds that offer a combination of debt and equity can provide more balanced investments with investment opportunities in target areas around the world.

+ Asset allocation funds are products of modern portfolio theory. Standard applications of modern portfolio theory include the effective frontier of stocks, bonds, and cash equivalents. Asset allocation funds try to create an optimal portfolio based on the investor's risk tolerance. Asset allocation funds are more likely to change endlessly. All funds will seek optimal diversification, but they all have different combinations of asset classes and follow unique internal rules. Some of the most common asset allocation funds include balanced funds and target-date funds.

Investors can access asset allocation funds by buying shares in mutual funds or exchange-traded funds (ETFs).

Asset allocation funds are developed from modern portfolio theory. Modern portfolio theory suggests that investors can achieve optimal returns by investing in a diversified portfolio that is included within an effective boundary.

Standard applications of modern portfolio theory include the effective frontier of stocks, bonds, and cash equivalents. Furthermore, modern portfolio theory outlines how an investment portfolio can change its asset mix to adjust to the investor's risk tolerance.

Thus, through the above analysis, it can be seen that foreign funds are funds established by investors when the headquarters of these funds are abroad. Foreign funds are run by investors, besides the benefits that foreign funds bring, it also has many risks.

Last updated